Mrs. Rachel Net Worth Husband: Exploring The Meaning Behind The Search

Have you ever found yourself curious about someone's financial standing? It's a pretty common thing, isn't it? Perhaps you've seen a name pop up, like "Mrs. Rachel," and your mind, you know, just starts to wonder about her financial situation, maybe even in relation to her partner. This kind of curiosity, it's almost a natural part of how we perceive success and stability in the world today.

When someone searches for "Mrs. Rachel net worth husband," it really opens up a conversation about more than just numbers. It touches on how we view women's financial roles within a marriage, and also, how those old-fashioned titles we use still carry a bit of weight, even if we don't always think about it. My text, for example, tells us that "Mrs." is a traditional title, used for a woman who is married or, perhaps, a widow. It’s short for "missus," and it has a long history, originally coming from "mistress," which was a title for both married and unmarried women in higher social circles. So, when we hear "Mrs. Rachel," we immediately know she's a married woman, and that context, in a way, can shape our perceptions.

This article aims to unpack that very query. We won't be sharing specific financial figures for *a* particular Mrs. Rachel, because, frankly, "Mrs. Rachel" is a general term for any married woman named Rachel, not a specific public figure whose finances are public knowledge. Instead, we'll explore the broader ideas behind this search: what does it mean to look into a married woman's net worth in relation to her husband's? How have perceptions of marital finances changed over time? And what role do these honorifics, like "Mrs.," play in our understanding of a woman's financial identity? It's a bit of a fascinating topic, if you ask me.

Table of Contents

- What Does "Mrs. Rachel Net Worth Husband" Even Mean?

- The Quest for "Mrs. Rachel Net Worth Husband": What Does It Reveal?

- Understanding Net Worth in a Partnership

- The Evolution of Women's Financial Roles

- Addressing the "People Also Ask" Questions

- Key Takeaways for Personal Finance

What Does "Mrs. Rachel Net Worth Husband" Even Mean?

When someone types in a phrase like "Mrs. Rachel net worth husband," it's pretty interesting, isn't it? It suggests a desire to connect a woman's marital status with her financial standing, and often, with her husband's too. This search, in a way, reflects a historical perspective on how finances were traditionally viewed within a marriage.

The Honorific "Mrs." and Its Origins

My text gives us some good insights into the title "Mrs." It tells us that "Mrs." is a traditional title for a married woman, and it's short for "missus." It actually comes from the honorific "mistress," which, back in the day, was used for both married and unmarried women of a certain social standing. So, you know, it's got a pretty long history. This title helps us specify a woman's marital status, and it’s generally considered polite to use it when addressing a married woman, as my text points out. It’s a very common way to show respect, and it’s been around for ages, really.

The text also mentions that in the past, it was quite common to see "Mrs." used before the woman's husband's first name. Think "Mrs. John Smith," for instance. This practice, in some respects, really highlighted the wife's connection to her husband's identity, which, you know, often extended to their shared social and financial standing. It’s a bit of a glimpse into how society used to view marital roles and identity, and how a woman's status was often tied to her husband's. This historical context is pretty important when we think about why people might search for a "Mrs." and her husband's net worth together.

Curiosity About Marital Finances

So, why the interest in "Mrs. Rachel net worth husband"? Well, it's often a blend of curiosity and, perhaps, a desire to understand the financial dynamics of a partnership. People might be trying to gauge financial success, or maybe they're just interested in how wealth is accumulated and managed within a family unit. It's a bit like wondering how any household manages its money, isn't it?

This curiosity can also stem from public figures or fictional characters. If there's a "Mrs. Rachel" who is well-known in some capacity, people naturally wonder about her background, including her financial situation. However, as we've discussed, "Mrs. Rachel" itself is a general term. So, the search really points to a broader interest in understanding how married couples, in general, handle their finances and what their combined wealth might look like. It's a way of trying to make sense of the financial world around us, and, you know, seeing how others are doing.

The Quest for "Mrs. Rachel Net Worth Husband": What Does It Reveal?

You know, it's pretty common for folks to be curious about the financial standing of people, especially those in the public eye. When a query like "Mrs. Rachel net worth husband" pops up, it kinda makes you wonder what information people are actually hoping to find, doesn't it?

Now, when we talk about a "Mrs. Rachel," it's interesting, because the title "Mrs." itself tells us a bit about social norms. My text, for example, explains that "Mrs." is a traditional title, usually used for a married woman. It’s short for "missus," and in times past, it was quite common to see this title used before her husband’s first name, like "Mrs. John Smith," which, you know, really tied her identity to his in a way. This connection, in some respects, often extended to financial matters too.

So, you might be looking for specific details about *a* Mrs. Rachel, maybe a public figure or someone you've heard about. However, the term "Mrs. Rachel" itself is a general one, referring to any married woman named Rachel. Because of this, we don't have a specific person's biography or personal financial details to share here, as that would be, well, inventing information. What we *can* explore, though, is the broader picture: what does it mean to ask about a married woman's net worth in relation to her husband's, and how have these ideas changed?

Understanding Net Worth in a Partnership

When we talk about net worth, it's basically a snapshot of someone's financial health. It’s what you own minus what you owe. For a married couple, this can get a little bit interesting, as there are different ways to look at it, you know? It’s not always as simple as just adding two numbers together.

Individual vs. Joint Assets

In a marriage, couples often have both individual and joint assets. For instance, one partner might have had savings or investments before getting married, and those might still be considered their individual property, depending on where they live and what agreements they have. Then, there are the joint assets, like a shared home, a joint bank account, or investments they've built together since saying "I do." So, a couple's total net worth is typically the sum of all these things, whether they're held individually or together. It’s a bit like a shared pie, with some slices clearly belonging to one person, and others being for everyone, so to speak.

It’s also worth remembering that debt plays a big part. Mortgages, car loans, student loans, credit card balances – these all subtract from the total. So, a true picture of a couple's financial standing considers everything, both what they have and what they owe. It’s a pretty comprehensive look, really, at their overall financial picture.

How Marital Status Influences Financial Perception

Historically, a woman's financial identity was very much tied to her husband's. When someone was referred to as "Mrs. John Doe," it often implied that her financial status was either directly dependent on his or completely intertwined with it. This perception, in some respects, meant that people might have assumed a married woman's wealth was simply part of her husband's. It's a rather traditional way of thinking, isn't it?

Even today, there can be an assumption that a married couple's finances are completely merged, even if, in reality, they maintain separate accounts or have different financial goals. The title "Mrs." itself, while simply indicating marital status, can still subtly reinforce this idea for some. However, modern marriages often involve partners with their own careers, incomes, and financial assets, leading to a much more nuanced picture of joint and individual wealth. It’s a far cry from how things used to be, and that's a good thing, really.

The Evolution of Women's Financial Roles

The way society views women's financial roles has changed quite a bit over time. What was once common practice is now, in many cases, a thing of the past. This shift, you know, has had a big impact on how we think about a "Mrs." and her financial standing.

Traditional Views and "Mrs."

For a very long time, especially in Western societies, a married woman, a "Mrs.," often had limited legal rights to her own property or earnings. Her financial identity was, for the most part, absorbed into her husband's. This meant that if you asked about "Mrs. Rachel's" net worth in, say, the 19th century, you would typically be asking about her husband's net worth, because her assets were legally his. My text, for example, mentions that "Mrs." is a traditional title, and this tradition, in some respects, goes hand-in-hand with those older societal norms where a woman's financial independence was not really a thing.

The title "Mrs." itself, in this context, really emphasized her marital status as her primary identifier, often overshadowing any individual professional or financial achievements she might have had. It was a time when a woman's social standing and financial security were almost entirely derived from her husband's position. It’s a rather stark contrast to how things are viewed today, isn't it?

Modern Financial Independence

Fast forward to today, and the picture is very different. Women, whether they are a "Mrs.," "Ms.," or "Miss," increasingly pursue their own careers, build their own wealth, and manage their own finances. Financial independence for women is not just a concept; it's a reality for many. Married women often contribute significantly to household income, and many maintain separate financial accounts or invest independently, even while sharing joint assets with their spouses. This shift, you know, has been a really important one.

The search for "Mrs. Rachel net worth husband" in today's world, therefore, needs to be seen through a more modern lens. It's less about a woman's finances being *part of* her husband's and more about understanding the combined financial strength of a partnership where both individuals contribute and manage wealth. It's about recognizing that a "Mrs." can, and often does, have her own substantial financial standing, whether it's combined with her husband's or managed independently. This is a pretty big change, and it reflects a lot about how society has progressed.

Addressing the "People Also Ask" Questions

When people search for things like "Mrs. Rachel net worth husband," they often have related questions that pop up in their minds. These questions usually touch on the practicalities of marital finances and the nuances of titles. Let's look at a few of those common inquiries, shall we?

How is a married couple's net worth typically calculated?

A married couple's net worth is, you know, usually calculated by adding up all their assets and then subtracting all their liabilities. Assets can include things like cash in bank accounts, investments (stocks, bonds, retirement funds), real estate (their home, rental properties), vehicles, and even valuable personal belongings. Liabilities, on the other hand, are debts, such as mortgages, car loans, student loans, credit card balances, and any other money they owe. The sum of all assets minus the sum of all liabilities gives you their combined net worth. It’s a pretty straightforward calculation, actually, once you gather all the numbers.

Do women always share their husband's net worth?

Not always, no. While married couples often combine finances to some extent, it's very common for individuals within a marriage to maintain separate assets and liabilities. For example, one partner might have inherited money or owned property before the marriage, and depending on legal agreements or state laws, those assets might remain separate. Also, many women today have their own careers and income, managing their own investments and savings independently. So, while they might contribute to a shared household budget or joint investments, their individual net worth might not be entirely merged with their husband's. It’s a much more flexible approach these days, you know, than it used to be.

What's the difference between "Ms." and "Mrs." in modern financial contexts?

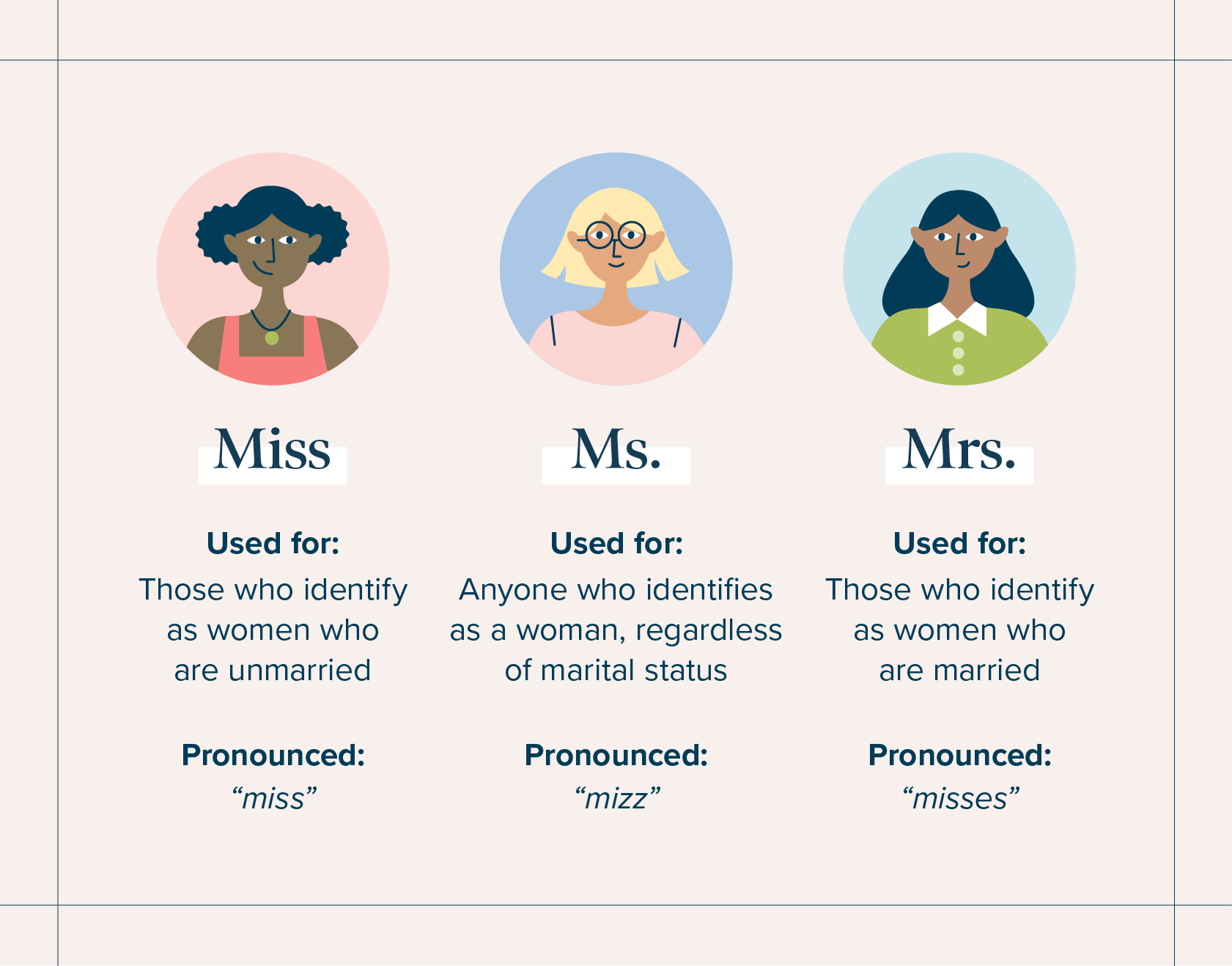

My text provides a great explanation for this! It says that "Mrs." is a traditional title used for a married woman, or a widow. "Ms.," on the other hand, is a versatile title that doesn't indicate marital status. It can be used for unmarried women, or for women whose marital status is unknown or irrelevant, or who simply prefer it. In modern financial contexts, the choice between "Ms." and "Mrs." really comes down to personal preference and, you know, doesn't typically have a direct impact on a woman's financial standing or how her net worth is viewed. A woman using "Ms." can be just as financially secure or independent as one using "Mrs." It’s about respect and choice, really, rather than financial status. Learn more about the usage of "Ms."

Key Takeaways for Personal Finance

When we look at the query "Mrs. Rachel net worth husband," it really highlights how our understanding of titles, marital roles, and finances has changed. It's clear that while the title "Mrs." tells us a woman is married, it doesn't, in some respects, tell us anything specific about her personal wealth or how it's managed within her marriage. The modern reality is far more diverse and independent than traditional views might suggest. It’s a pretty important distinction, if you ask me.

For anyone thinking about personal finance, whether you're married or not, the key is always clarity and communication. Knowing your own assets and liabilities, discussing financial goals with your partner, and understanding how joint and individual finances work together are all very important steps. It's about building a strong financial future, you know, that works for everyone involved. You can learn more about personal financial planning on our site, and perhaps explore more about managing household budgets effectively.

What's the Difference Between Miss, Ms., and Mrs.? | YourDictionary

The Difference Between Ms, Mrs and Miss - Zola Expert Wedding Advice

Mrs (2023)